In an exciting development, Ayala and Alibaba-backed mobile wallet GCash has announced its availability in 16 countries worldwide. This expansion opens up new possibilities for Filipinos living abroad, providing them with a convenient and secure way to manage their finances.

Where Can You Use GCash?

Filipinos residing in the following countries can now download and use the GCash application:

- United States

- Canada

- United Kingdom

- Spain

- Italy

- Germany

- Qatar

- Japan

- South Korea

- Taiwan

- Hong Kong

- Australia

- United Arab Emirates

They can utilize their Philippine SIM cards or local mobile phone numbers to access GCash services. Additionally, GCash will soon launch in three more countries: Saudi Arabia, Singapore, and Kuwait.

Meeting the Financial Needs of Global Filipinos

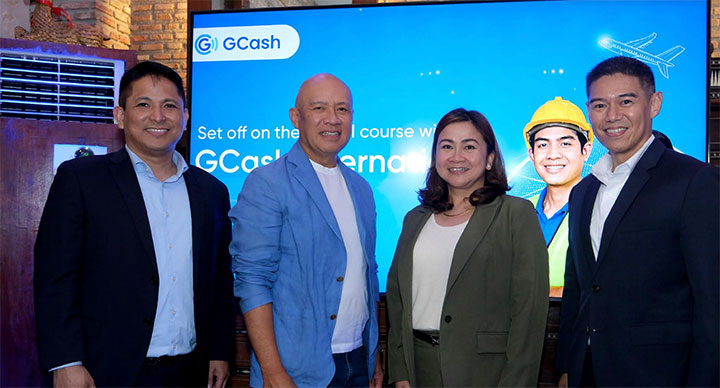

Paul Albano, the general manager of GCash International, emphasizes the importance of addressing the financial needs of over 13 million Filipinos living abroad. With GCash’s global availability, these individuals can:

- Send Money Back Home: Whether it’s supporting family members or covering essential expenses, GCash allows Filipinos to send money to their loved ones anytime, anywhere.

- Manage Bills: GCash users can pay bills seamlessly, ensuring that household utilities, tuition fees, and taxes are taken care of efficiently.

- Stay Connected: Need to recharge your mobile phone? GCash makes it easy to purchase mobile phone load, enabling uninterrupted communication via chat or video calls.

Strategic Partnerships

GCash has forged key partnerships to enhance its services:

- Ikon Solutions Asia Inc.: This licensed recruitment agency collaborates with GCash to equip Overseas Filipino Workers (OFWs) with essential digital financial tools.

- Alipay+: GCash’s partnership with this global payments platform expands its reach. Through Global Pay, GCash users can now transact with over three million Alipay+ enabled merchants across 17 countries and territories, including Japan, South Korea, and Singapore.

Conclusion

GCash’s expansion beyond the Philippines is a significant milestone. As global Filipinos embrace cashless digital economies, GCash stands as a reliable and efficient fintech solution, bridging the gap between distant shores and ensuring financial well-being for all.